HMRC approved mileage rates from 2011/12 onwards

November 20, 2018

If you're self employed HMRC will allow you to claim for the cost of business journeys in two ways:

1) A percentage of all your car expenses based on the proportion of business miles you do. You may also be able to claim for the cost of your car as well.

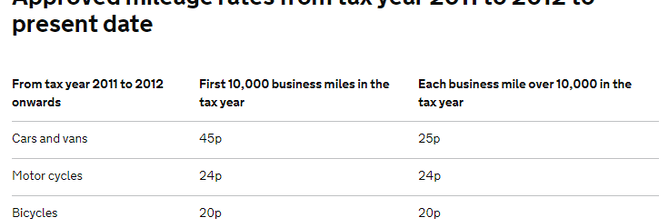

2) An approved milea...

In very simple terms, during the current tax year, which will end on 5 April 2019, everyone can have an income of up to £11,500 without paying any tax (but see the notes below). Don’t forget that income is the total of what you have been paid by clients less your business...

How to stop AdultWork adding VAT to their fees

February 14, 2017

AdultWork will automatically add 20% VAT to the fee they charge you unless you prove you're a UK business.

To do this you'll have to complete VAT Details page which you can find on the AdultWork website at My Details/Credits/Transfer Request Form. Where it says "

Note: Are ...

How much should I save for my tax?

January 11, 2017

After you've been self employed for just over a year you'll start to pay your tax and national insurance every six months based on your previous year's income.

And this is where it starts to become difficult because how do you know, until you reach that stage, how much you...

HMRC - don't leave it too late

December 4, 2016

If you were self employed at any time during the period 6 April 2015 to 5 April 2016 you will have to submit a 2016 tax return to HMRC.

The deadline for filing this return is 31 January 2017 which may seem a long time away but you must remember two things:

You have to su...